- Copper Futures are Bright

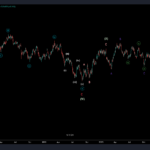

by GupEEThere are multiple degrees of trend here at play for Copper. The first thing I look for for a trading opportunity is corrective behavior into an Elliott Wave guideline. In this case, a fourth wave finding footing near the terminus of the previous fourth wave of lessor degree. Next, I want to see an impulsive… Read more: Copper Futures are Bright

by GupEEThere are multiple degrees of trend here at play for Copper. The first thing I look for for a trading opportunity is corrective behavior into an Elliott Wave guideline. In this case, a fourth wave finding footing near the terminus of the previous fourth wave of lessor degree. Next, I want to see an impulsive… Read more: Copper Futures are Bright - Coffee is Ready to Take a Ride

by GupEELike FOREX pairs, commodities are often very long to correct and have blow off tops. While I’m not certain on the long term count, I can isolated a highly probable next move in a flat pattern visible clearly on the daily timeframe. Where that flat pattern fits in to the bigger picture doesn’t much matter.… Read more: Coffee is Ready to Take a Ride

by GupEELike FOREX pairs, commodities are often very long to correct and have blow off tops. While I’m not certain on the long term count, I can isolated a highly probable next move in a flat pattern visible clearly on the daily timeframe. Where that flat pattern fits in to the bigger picture doesn’t much matter.… Read more: Coffee is Ready to Take a Ride - Silver Patience Will Pay Off

by GupEEWe’ve been patient for a long while with Silver. The consolidation has taken four years, what’s another couple months? When practicing as an Elliottician, it is important to not rush the process. What we are after are high confidence trading setups. If your goal is to catch every top and every bottom for every asset,… Read more: Silver Patience Will Pay Off

by GupEEWe’ve been patient for a long while with Silver. The consolidation has taken four years, what’s another couple months? When practicing as an Elliottician, it is important to not rush the process. What we are after are high confidence trading setups. If your goal is to catch every top and every bottom for every asset,… Read more: Silver Patience Will Pay Off - Long Term Bonds Have Arrived

by GupEEThere has been some discussion in the chat recently regarding long term U.S. Treasury Bonds. As part of the Chart Wizard Trading service, I personally count this chart and offer my opinion on it. I do this for multiple reasons. Firstly, Bonds are generally safe, as long as you know when to be in and… Read more: Long Term Bonds Have Arrived

by GupEEThere has been some discussion in the chat recently regarding long term U.S. Treasury Bonds. As part of the Chart Wizard Trading service, I personally count this chart and offer my opinion on it. I do this for multiple reasons. Firstly, Bonds are generally safe, as long as you know when to be in and… Read more: Long Term Bonds Have Arrived - A 50% Trading Opportunity for Solana

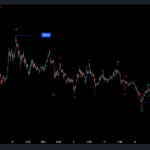

by GupEEThe reaction down from the medium term high at $126.39 subdivides as a double zigzag. Giving confidence that it was a corrective move and not motive. The reaction from $78.87, the end of the double zigzag, subdivides nicely as an impulse. In the near term, a impulsive channel has broken in a decline which is… Read more: A 50% Trading Opportunity for Solana

by GupEEThe reaction down from the medium term high at $126.39 subdivides as a double zigzag. Giving confidence that it was a corrective move and not motive. The reaction from $78.87, the end of the double zigzag, subdivides nicely as an impulse. In the near term, a impulsive channel has broken in a decline which is… Read more: A 50% Trading Opportunity for Solana